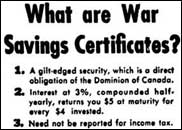

Everyone was encouraged to lend money, thus certificates were made small enough for the majority to do so. The denominations of $5, $10, $25, $75 and $100 were offered to the public beginning on 27 May 1940. A certificate held for 7 ½ years to maturity would increase in value by 25%. For example, a certificate purchased for $4 was worth $5 at maturity. A person could buy up to $500 worth in any calendar year. This was later raised to $600.

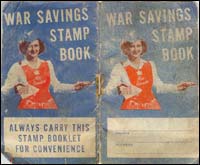

The certificates were issued upon application accompanied by cash, cheque or money order to any bank, post office or authorized selling agency. Anyone unable to purchase outright the smallest certificate [$5 in 1940 = $67.26 in 2005] could buy one in installments through war savings stamps. These individual 25¢ stamps produced by the Post Office Department could be acquired at a bank or post office. Children, in particular, were encouraged to take part in the stamp program. Small paper folders were available for collecting stamps.

By the end of 1940 heavy demands for war materials through industrial production led the government to seek more loans from Canadians. The national War Savings Committee urged employers and employees to increase contributions to the certificate program. The objective for these systematic payroll deductions was $10 million per month. Meanwhile individuals were encouraged to buy certificates by instructing banks to deduct set amounts from their personal accounts on a regular basis.

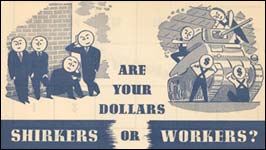

To ensure that every person was involved in war savings, the government designated February 1941 as War Saving Pledge Month. An ad stated, "Canadians are all in the 'financial forces' - ours is the responsibility of seeing to it that our fighting forces have the adequate and vital supplies and equipment to bring about victory." Numerous full-page ads led up to the designated month.

To ensure that every person was involved in war savings, the government designated February 1941 as War Saving Pledge Month. An ad stated, "Canadians are all in the 'financial forces' - ours is the responsibility of seeing to it that our fighting forces have the adequate and vital supplies and equipment to bring about victory." Numerous full-page ads led up to the designated month. On Launch Day, 1 February, potential subscribers were told about the red, white and blue cards in the shape of a maple leaf that would be given out for display purposes. A special pledge to bolster the cause was also introduced. Local canvassers hurriedly organized and went door-to-door seeking pledges and passing out lapel buttons to those willing to commit to being a regular buyer of War Savings Certificates.

The Summerside canvass was considered satisfactory with 915 pledges representing $40,000. For those people who did not pledge at the door, they could mail their "Honour Pledge" to Ottawa. Citizens were reminded that a financial commitment could be made through a Payroll Savings Plan or on a Bank Pledge form.

The County chairman pointed out that the actual number of pledges was probably much higher because some citizens chose these other routes and were not included in the public statistics. The household canvass of the town was supplemented by the participation of the RCAF Station where there was a good response. The students at Summerside High School also became involved in the campaign, purchasing more than $1000 worth of stamps and certificates.

The County chairman pointed out that the actual number of pledges was probably much higher because some citizens chose these other routes and were not included in the public statistics. The household canvass of the town was supplemented by the participation of the RCAF Station where there was a good response. The students at Summerside High School also became involved in the campaign, purchasing more than $1000 worth of stamps and certificates.An editorial in the Journal in April 1941 praised the benefit of war savings and listed as part of the program's objectives the restriction of civilian consumption and the development of a thrift habit. A series of ads that month encouraged citizens to buy certificates on a regular basis.

The next War Savings drive was held in October 1941. The slogan was "Spend Less - To Buy More." The Canadian Post Office issued eight specially designed War Savings Stamps to replace the earlier plain ones. The objective for PEI was to subscribe enough money for the purchase of one anti-aircraft gun every month for the duration of the war.

The next War Savings drive was held in October 1941. The slogan was "Spend Less - To Buy More." The Canadian Post Office issued eight specially designed War Savings Stamps to replace the earlier plain ones. The objective for PEI was to subscribe enough money for the purchase of one anti-aircraft gun every month for the duration of the war. Advertising and promotion for war savings were continued in 1942. The chartered banks used the slogan "To Save is Practical Patriotism" and ran a series of ads on that theme. The stamp program had a "Saving Is Serving" symbol. School children were invited to learn a Saving Stamp Song.

In 1942 retailers became sales outlets for stamps by asking customers to take part of their change in War Savings Stamps. This meant that people could now acquire stamps at banks, post offices, druggists, grocers, department stores, plus any retailer who displayed the special sign. Groups as well as individuals contributed to the effort. For example, Trinity United Church in Summerside purchased certificates in March 1942 under a program for the United Churches across Canada.

Also in 1942, certificates became available for immediate delivery at banks and post offices, rather than the previous application process. In the weeks leading up to Christmas 1942 and 1943 special Christmas cards were distributed at no charge by banks, post offices, and stationery stores to anyone wanting to give a War Savings Certificate as a gift. Around that same time a newspaper article urged citizens not to cash their certificates before they matured.

In 1943 the Minister of Finance asked the Food Industry of Canada to promote the sale of War Savings Stamps in a month long campaign. February was chosen for the "March to Berlin" drive to have consumers take stamps as part of their change during a food purchase. The PEI sales were $12,513 or 202% of the goal.

In 1943 the Minister of Finance asked the Food Industry of Canada to promote the sale of War Savings Stamps in a month long campaign. February was chosen for the "March to Berlin" drive to have consumers take stamps as part of their change during a food purchase. The PEI sales were $12,513 or 202% of the goal.  A campaign in the summer of that year was called "Stamp Out the U-Boat." The national goal was $1,350,000 in order to provide 15,000 depth charges for the Canadian Navy. The Y's Men Club was the local sponsor and created a contest among local store clerks. A prize of a $5 certificate was presented each week from 5 to 31 July to the clerk having the highest stamp sales. Miss Doris MacArthur, sales clerk at Geo T. Clark's Jewelry Store won the competition for three out of the four weeks, with a grand total of $440 in sales.

A campaign in the summer of that year was called "Stamp Out the U-Boat." The national goal was $1,350,000 in order to provide 15,000 depth charges for the Canadian Navy. The Y's Men Club was the local sponsor and created a contest among local store clerks. A prize of a $5 certificate was presented each week from 5 to 31 July to the clerk having the highest stamp sales. Miss Doris MacArthur, sales clerk at Geo T. Clark's Jewelry Store won the competition for three out of the four weeks, with a grand total of $440 in sales.The stores of Holman's, Sinclair & Stewart, and Stedman's set up special booths to be staffed by volunteer women several afternoons a week. A group of local girls called the "Miss Canada" team were very dedicated to the campaign and some won prizes for their efforts. The community effort was very successful with enough money coming in to supply 118 depth charges, well over the goal of 75.

Some local initiatives were also undertaken. In August 1943, a regular series of ads by local businesses began to be published. Readers of the Summerside Journal could claim prizes if their names appeared on the full-page feature. In the summer of 1944, the newly organized provincial branch of the Women's Division of the National War Finance Committee created a special program. Under the "inspired leadership" of Mrs. Thane Campbell of Summerside, the PEI members encouraged citizens to become part of "The 25 Club." Attractive booklets were distributed for anyone volunteering to purchase at least one 25¢ stamp each week.

In 1944 the Food Industry of Canada once again promoted a food stamp sale in the month of February. The third national food stamp sale was held from 2 February to 9 March 1945. The Summerside committee consisted of L. W. Hancock, J. Frank Arnett, H. T. Holman, Jr., Hazen Phillips and J. Lloyd Gorrill. There were over 30 food-handling firms in the town so expectations were high to meet the goal of 10,000 stamps. About twenty Girl Guides were in the stores on Saturdays during the month and sold more than $700 worth of stamps. Summerside managed to double its objective and PEI led Canada in this last drive for War Savings Stamps.

The War Savings program was designed to attract Canadians to invest a portion of their current income on a consistent basis. There was another method of raising funds for the war that ran in conjunction and co-operation with it. The Victory Loan program urged citizens to purchase bonds from savings accumulated out of past income. A separate section is devoted to that type of investing.

| Related Articles | Related Images | Related Memories | Related Websites | Inflation Calculator |

| Home Page | Site Map | Contact Us | Wyatt Heritage Properties |